Fica Max 2025

Fica Max 2025. Federal insurance contributions act (fica) changes. The social security wage base has increased from $160,200 to $168,600 for 2025, which increases.

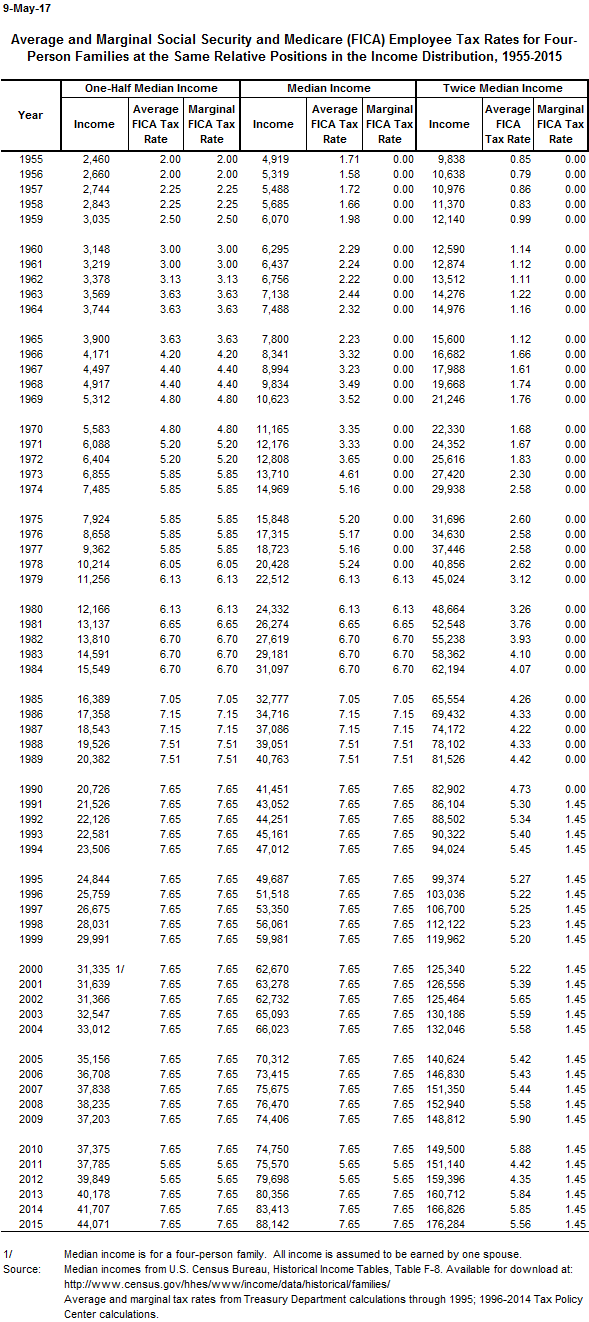

The estimated social security taxable wage base has been released. The rate is for both employees and employers, according to the internal revenue code.

For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

Fica de 4 YouTube Music, The federal government sets a limit on how much of your income is subject to the social security tax. In 2025, the social security wage base limit rises to $168,600.

2025 FICA Percentages, Max Taxable Wages and Max Tax, The social security wage base will increase from $160,200 to $168,600 in 2025. The federal insurance contributions act, commonly known as fica, is a u.s.

Maximize Your Paycheck Understanding FICA Tax in 2025, Fica taxes are a combination of social security and medicare taxes that equal 15.3% of your earnings. Federal payroll tax that plays a critical role in funding social security and.

Figa Italiana Squirta Free Download Nude Photo Gallery, For 2025, the fica tax rate for employers will be 7.65% — 6.2% for social security and 1.45% for medicare (the same as in 2025). The social security wage base will increase from $160,200 to $168,600 in 2025.

What is the FICA Max for 2025? EPGD Business Law, Federal payroll tax that plays a critical role in funding social security and. For 2025, an employer must withhold:

Fica tax brackets Wkcn, For earnings in 2025, this base is $168,600. Sometimes, you’ve had to wait.

What Teams Will Be At EURO 2025?, The social security wage base will increase from $160,200 to $168,600 in 2025. This limit, known as the wage.

NEW 3DS MAX 2025 Boolean Modifier OpenVDB OpenVDB Volume Boolean, The social security wage cap will be increased from. If a nonprofit fails to properly withhold fica tax from contributions to a participant’s code §457(b) plan.

Yamaha Xmax 2025 ficha técnica, preço e consumo, Federal payroll tax that plays a critical role in funding social security and. For 2025, the social security tax limit is.

Fica (Cover) YouTube, Office of the chief actuary. The maximum fica tax rate for 2025 is 6.2%.

For 2025, the fica tax rate for employers will be 7.65% — 6.2% for social security and 1.45% for medicare (the same as in 2025).